Hercules Volatility Manual

Volatility context first, execution second, outcomes follow.

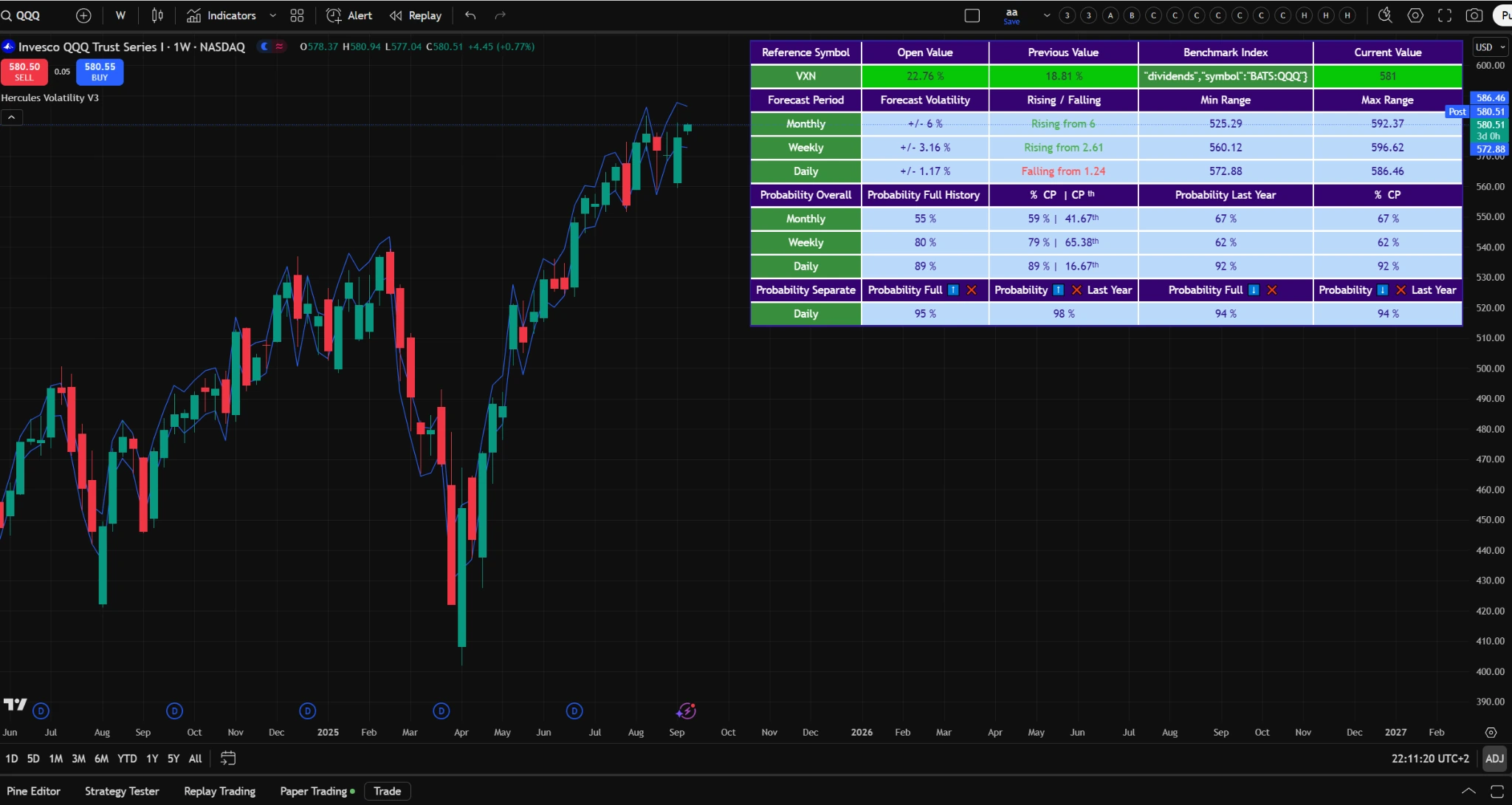

Reads volatility regime from a comparative symbol like VIX or VXN, then projects expected price ranges

Shows probability of daily range breaches under rising or falling volatility conditions, full history and last year views

Surfaces percentile context to avoid forcing trades during extreme fear or complacency

- Daily, weekly, and monthly rails derived from the volatility symbol, scaled by your multiplier

- Probability tiles for breaches conditioned on volatility direction and optional percentile windows

- Focuses on quality of decision and Discipline Score, not prediction of direction