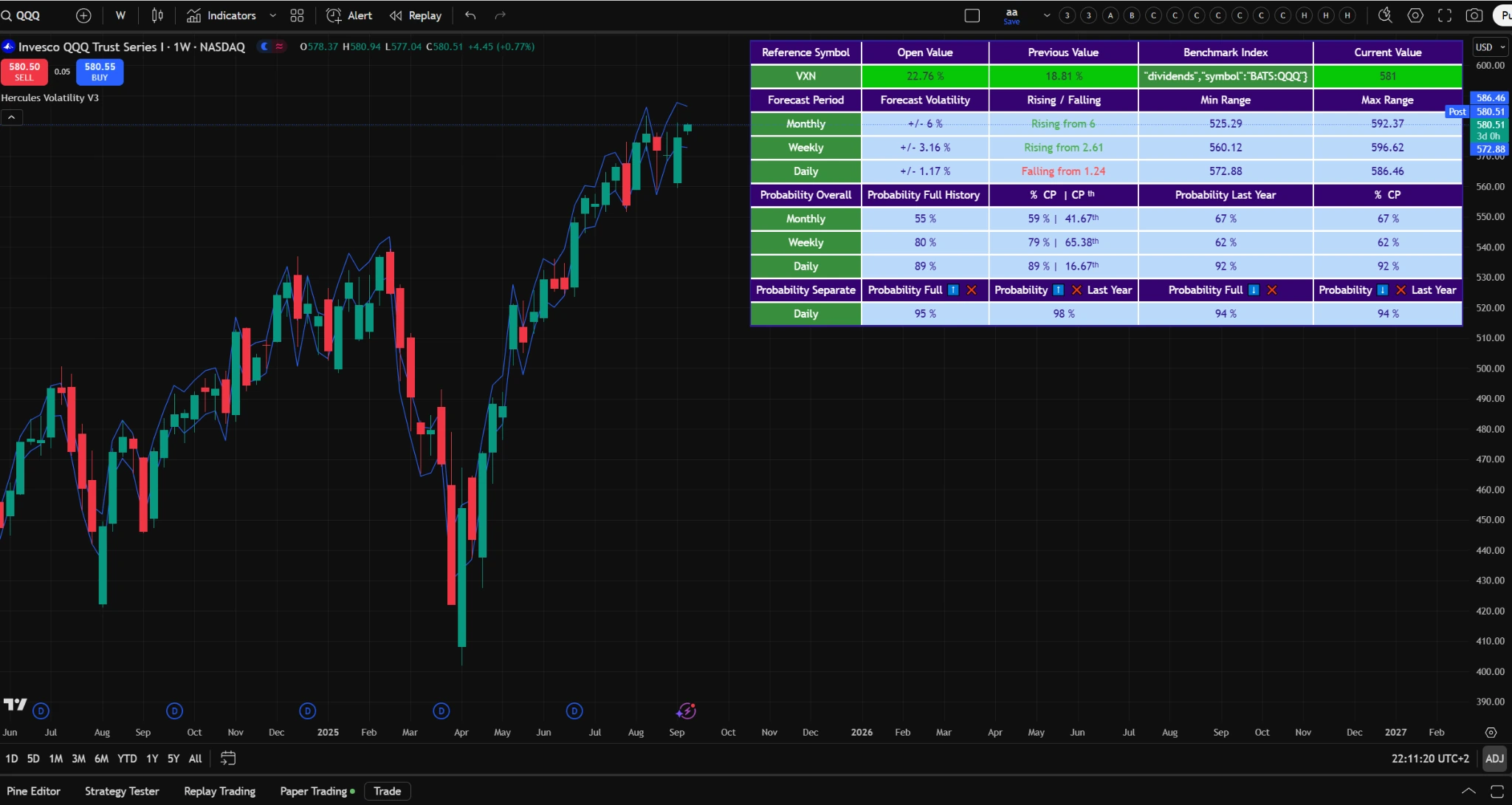

Hercules Volatility Guide

The model anchors on a volatility symbol like VIX or VXN. It derives annual volatility from the open, then scales it to quarter, month, week, day, and hour. Those levels define expected rails for the traded index or asset and feed probability tiles for range breaches under rising or falling volatility states. Percentile windows and a year filter refine the context.

Overview

Comparative symbol

VIX for SPX, VXN for NASDAQ, or any suitable volatility proxy

Rails

Daily to monthly ranges derived from the volatility open and scaled by multiplier

Probabilities

Breach rates under rising or falling volatility, with optional percentile and time filters

Mechanics

Inputs from the volatility anchor

The model reads open values of the selected volatility symbol on daily, weekly, and monthly frames. It derives annual volatility, then scales it to quarter, month, week, day, and hour using square root of time.

Expected range rails

From the index open or current value it computes min and max range for each timeframe. Rails update as volatility changes.

Probability tiles

It classifies volatility as rising or falling relative to the prior period, then tracks how often price breached the expected range. It reports full history and last year, plus percentile filtered variants.

Percentile context

Current percentile of volatility on daily, weekly, and monthly frames helps decide if conditions are stretched. Windows are configurable to focus on normal or extreme regimes.

Inputs

volatility_ticker

Default VIX. Use VXN for NASDAQ. Choose a symbol that matches your traded index or asset class.

multiplier

Scales the volatility based rails. Start at one, adjust after journal review.

anyo

Backtest start year for the last year views and time filters.

percentile_input and percentile_input_max

Window for filtering the probability tiles by current percentile of volatility.

TableLocation and TableTextSize

Display controls for the table on chart.

Workflow

- Select the correct volatility anchor for the asset you plan to trade.

- Read the percentile of current volatility and the direction state rising or falling.

- Check rails and breach probabilities for full history and last year on the timeframe you trade.

- For options selling around thirty to forty five days to expiry, place strikes outside the rails when feasible and align with the direction cue.

- Size by volatility. When rails expand and breach risk rises, reduce size or wait. When rails contract and probabilities improve, consider normal size with strict stops.

- Log decisions and update the Discipline Score.

Risk and sizing

- All outputs are context, not guarantees.

- Respect fixed risk per trade and portfolio wide limits.

- Avoid initiating new risk at extreme percentiles unless your plan requires it.

- Use liquid underlyings and clean exchange feeds.

TradingView setup

- Apply the indicator on the traded symbol and set the volatility ticker to VIX or VXN as needed.

- Use dark theme for parity with the site and clarity of the table.

- Save layouts per asset class for faster switching.

- Hide unrelated indicators when reading probabilities.

FAQ

Does it tell me when to buy or sell

No. It provides educational analytics and context. You decide entries and exits inside your plan.

Which assets are supported

Equities, indices, futures, FX where data is reliable and liquid. Use the appropriate volatility anchor.

What about options selling

The model assists with context for options selling around thirty to forty five days. It never replaces your plan.

How does the Discipline Score work

It increases when you follow your plan, respect stops, and size correctly, and decreases when you deviate. It is a behavior loop.

Examples

Screens with the probability table visible.

Compliance

Educational analytics and model signals. No personalized investment advice. We do not assess suitability, we do not execute trades, and we do not hold client assets. You are responsible for your decisions, sizing, and execution.

This product is offered as research and software access. Payments via Stripe or crypto are for software and educational content, not for investment services. Taxes and refunds are handled by Stripe where applicable. Crypto payments may be subject to basic AML checks.

Built with European regulatory context in mind and framed as education and research. Nothing here should be interpreted as a solicitation to engage in specific transactions.

Professional-Grade Algorithmic Strategies

Unlock disciplined frameworks engineered to withstand volatility, benchmarked transparently, and updated with integrity. Every model is delivered with equity curves, rules, and methodology.

Clear rules and guardrails, documented methodology

Live equity curves and benchmark comparison

Update cadence and transparency archive

Models are educational demonstrations on market data. They are not investment advice or personalized recommendations.