Hercules Volatility Harvest

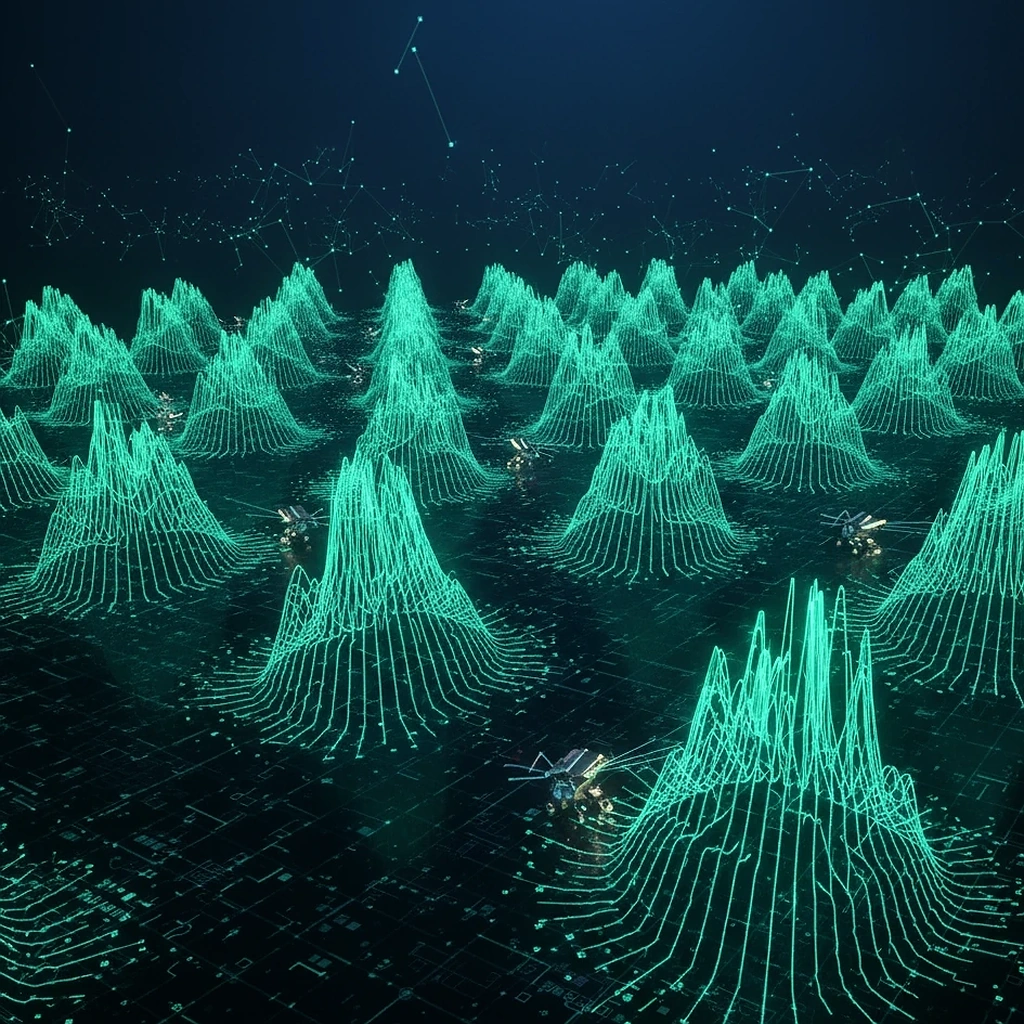

Turn fear into yield. Harvest volatility like pros harvest crops.

Identify contango and backwardation regimes before they bite portfolios

Mathematics with convexity awareness that filters noise but reacts to shocks

Allocation logic that exploits VIX structures while shielding against tail risk

- Volatility is the most misunderstood market. This turns it into a predictable harvest

- Kalman smoothing transforms chaos into structure, showing you when to plant and when to cut

- Strict caps and event awareness keep the tail from ever wagging the dog